Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

When Jim and I quit our finance jobs to start the next big thing, we were really unprepared for our startup journey.

We didn’t have startup experience, we had no real domain expertise (our startup wasn’t going to be about finance) and we didn’t know any investors in the tech community.

There was very little reason for them to want to invest in our startup.

Exactly three years later, we raised $1.3 million for Yipit, a daily deals aggregator, from Ron Conway and David Lee’s SV Angel, RRE, DFJ Gotham, IA Ventures and a handful of other amazing tech investors.

This post isn’t about the tactics we used once we started getting interest, I’ll share that with you later and you should check out VentureHacks. The point of this post is more to share how we put ourselves in a position to get interest from high-profile tech investors. Hopefully, it well help you as you try to do the same.

Note: We didn’t think of raising money as a goal. I highly encourage you to consider starting a boot-strapped cash-flow positive business. For us, the ideas we working on needed scale before we could monetize them which required us to raise funding.

How We Did It

Below are the the key moments in our journey:

- Realized we needed traction. This was key. Unless you’ve successfully started another company or have serious domain expertise (we didn’t), you need traction. Traction is essentially positive momentum in customer growth. For us, it would mean sharp user growth. Trying to raise money before traction is largely futile. So, we stopped putting together business plans and powerpoint presentations and set out to build a prototype that would get us traction.

- Built relationships with potential investors. While we built our prototype, we started meeting with potential investors. To be *very* clear, we were not asking them for money and didn’t bring presentations. We just wanted them to know who we were and what we were working on. The first two investors who committed to our round came from these early meetings. I also remember another investor positively commenting that “we were known entities”. In other words, they were more comfortable investing in people they had known for a while.

- Released our prototype. The initial version of Yipit was an aggregator of all sample sales, happy hours, deals happening in New York. We put out a private beta in June of 2009 and publicly released it in December of 2009. By end of January, we had a few thousand people signed-up. Not bad, but we didn’t have real momentum.

- Decided to raise a small seed round. At this point, we had been living off of our savings and had decided to finally raise a small seed round to cover our expenses and start paying ourselves a small salary to end our savings leaking. We met with a few investors and they weren’t interested. We didn’t have traction. So, we immediately canceled meetings with other investors. We instead turned to people who were willing to invest in us because they believed in us: our friends and family. We quickly closed the round in late January.

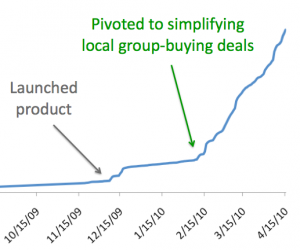

- Pivoted to focus on aggregating just daily deals. During our meetings with investors, we heard two business critiques: we couldn’t easily scale to other cities (this was true) and it would be hard to monetize beyond basic email advertising (also true). Fortunately for us, while we spent all this time organizing deals, a very successful company launched called Groupon that created deals in cities. By late January, there were 12 companies now doing exactly what Groupon did. We then pivoted Yipit in February to just focus on aggregating these new daily deals. The new version addressed the two main concerns we had heard from our investors: we launched in five cities and we could monetize via affiliate relationships.

- Pivot got us traction. As you can see from the chart, our user growth shot up and we now had real momentum and traction.

- Investors started calling. By April, we started getting calls from investors wanting to know more about Yipit. At this point, we were getting buzz in the press, signing up users and the industry was on fire as Groupon and LivingSocial were raising huge rounds and there were now 40 plus daily deal services.

- Decided to raise large seed round. We decided to raise around $1 million round to build out the team and give us 18 months to hit certain milestones. Because we had built up relationships with investors, we didn’t have to cold email anyone. We just reached out to them and met with the investors that were calling us.

- Demonstrated we weren’t naive. As a first time-entrepreneur, investors are worried you are naive about the challenges facing your startup over the next 12 months. Every startup has risks and your startup and our startup are no exceptions. When an investor would bring up a risk, we wouldn’t vigorously defend ourselves saying it wasn’t a risk. Instead we would tell them that it was a real risk for us and we were very focused on mitigating that risk over the next 9 months by doing X, Y and Z.

- Got first lead investor. RRE was the first to commit to investing in us and it all got really easy from there. The social proof of having an investor with a great reputation backing you does wonders for your fundraising process.

- Closed up the round. We had calls, meetings with potential investors almost every day in May and closed the round at the end of June. Aside from investors reaching out to us, the best source of investor leads is to ask the investors who are committing to recommend other investors that might be interested. We also used VentureHack’s AngelList at the very end. (Will be sharing more about our experience closing the round in future posts).

Getting Traction was HUGE

As you can see, getting traction was huge for us. But, we were also well-positioned to take advantage of it because we had built relationships with investors and had been keeping their feedback in mind.

If you’re trying to raise money as a first-time entrepreneur, I really recommend you get a prototype out there and find your traction before you spend time creating decks and pitching investors. And, if you need to raise money in order to build a prototype, you are underestimating what you are capable of.

Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

Lastly, what are we doing with the new round of funding? We’re expanding the team.