Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

After raising our $1.3 million seed round for Yipit, we raised $6 million a year later from Highland Capital, RRE, IA Ventures, DFJ Gotham and others.

It turns out that the process of raising a $1.3 million seed round and raising a $6 million round were different in a few key ways that we did not fully anticipate and we learned a lot.

Given the supposed “Series A Crunch”, I wanted to share some of those lessons as well as tips from other founders who have gone through the same process.

When trying to navigate the process of raising that next round, here are some things to keep in mind:

- It’s about the partnership, not just one partner. For most seed rounds, if you get a partner excited, that’s all you need. That’s not true for this round. You’ll need the whole partnership to be on board. Assuming you’ve gotten one partner excited about the investment, I’d ask to meet one-on-one with a few other partners and get them excited. That way, when you pitch the whole partnership, you already have several partners looking to do the deal. As you can imagine, partnerships are a complicated series of relationships and the more allies you have, the better.

- Have a big vision. My experience was that raising the seed round is about credibility. It’s about showing that you and your co-founder were capable of building something real and recruiting a team. This next round is a big round. Whichever VC firms leads this investment will make you one of their 20 or so main portfolio companies. They want to believe you are going to build a $100 million plus company and not a probable $20 million company. Instead of leading with your traction, you might consider leading with your bold vision. For example, if you were AirBnB, you might say something like: “Soon, more people will be renting rooms from AirBnB than from hotels.” And, instead, use your traction later to support your vision: “as you can see, we’ve had 10% growth in rooms booked for the last 5 months.”

- Don’t sign a term sheet unless you are certain they’ll do the deal. In the seed round, it seemed like once you signed the term sheet, things were pretty much done. In this round, the firm will do much more due diligence on your company, your team, your customers and your space. If you sign the term sheet, you’ll get locked down for 30 to 60 business days (1.5 to 3 actual months!). That’s a long time for someone to come back to you and say no. Worse, other investors will know that a VC firm walked away from a signed term sheet after doing due diligence. That doesn’t look good. Make sure they do their diligence up front. Make sure you have heart-to-heart with the partner about their biggest concerns and try to address those before you sign the term sheet.

- Know your investor’s target return. You want to know how much your investor is looking to return from their investment in your company so that you make sure you’re pitching the right firm with the right message. For example, do they expect you to sell for $100 million or $1 billion? You can always ask them but there’s a rule of thumb I use. It’s very rough, but it’s in the ballpark. When a partner commits to your company, they’ll consider your investment a real success if they get back 1/3 of their fund. So, if you’re talking to an investor with a $100 million fund. They’ll want your company to return to them $30 million. If they’ll get 20% of your company for the doing the deal, that’s a $150 million target. If the fund is $300 million, then they are expecting $450 million. Again, this is a very rough estimate but it’s helpful. For more on this, see this excellent post by Tomasz Tunguz.

- You might want to exclude strategics from the “no shop” provision. When word gets out that you are doing a funding round, strategics will start popping up and think about acquiring you for many reasons including that you’re about to become a much more expensive acquisition target and the social proof of a smart VC thinking your business is going to become really big. The “no shop” provision means that you’re not going to take the signed VC term sheet and try to get another VC to give you a better one. But, often, it also says that you won’t engage with any strategics about an acquisition. If getting acquired is something that interests you or your early investors, make sure to ask your lawyer to make it so that the “no shop” only applies to other VC’s.

- Your industry will not always be this hot. If you’re having serious interest for your next round, it’s likely that your overall industry is very hot right now (e.g., 3D printing, virtual currencies, content marketing, google glass apps, etc.). Unfortunately, all industries have their ups and downs. Before long, your industry will become cold again. If you don’t raise your round before that happens, you might be left out in that cold. Raising a round when your industry starts to weaken and having a competitor or two already funded will make your job much, much harder.

Whether or not there’s a Series A crunch, I don’t really know. What I do know is that raising a round after your seed round is much harder. I hope these tips will help make it a little less hard.

If you have your own lessons raising another round after your seed, please comment below!

Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

Since going down the startup path, I’ve made so many mistakes, struggled so many times, failed in almost every way you can.

But, we turned the corner after a few years of hard work. We’re now 25 people (we’re hiring!), raised $7.3 million, and just had our best month ever.

I often fantasize about going back in time and giving myself advice based on what I’ve learned over the last 5 years.

I probably wouldn’t have listened but here’s what I would have told myself:

- Teach yourself to code. After a disastrous experience outsourcing, you’ll eventually make this decision. I just want you to make that decision today. Of all the things that will happen, this is the single biggest step function change you’ll experience. Also, I know your outsourcers used Perl but please do not teach yourself Perl. Teach yourself Python/Django or Ruby on Rails.

- Stop holing yourself up in your apartment. You think that an hour spent working is more productive than grabbing coffee with another founder. The problem is that you don’t yet know what to do in that hour. Talking to other founders, you’ll get some valuable advice that will help you save weeks of time. Plus, those founders will eventually introduce you to new hires and investors.

- Don’t be afraid to talk to potential investors. You keep avoiding it because you know you’re not yet ready to raise funding. While you’re right, you should still meet with them to get advice. Investors want to have a relationship with you and not just shotgun fund you. When you finally do raise a round of funding, it will have been with investors who had already gotten to know you.

- Stop worrying about PR. You spend too much time thinking about it. Your startup won’t take off because you got great PR. It will take off because you built a great product. PR is a good way of getting some early test users. It’s not how your company will take off.

- You’re not supposed to know what you’re doing. You keep trying to rely only on your instincts. The truth is, your instincts are terrible. You don’t know what your’e doing and it’s okay. You’ll realize this at some point and go out and get advice. You’ll eventually stumble into the Lean Startup movement. I just want you to do this sooner.

- Celebrate the small victories. That feeling that you’re not quite where you want to be won’t go away. The way you feel now hoping to get your first 1,000 users, you’ll feel the same way when you’ve raised $7.3 million and have 25 people working on the team. You’ll never be satisfied with your progress so take time to celebrate the milestones.

- Don’t worry about all the problems you don’t have yet. Focus on the one big problem in front of you. There’s a good chance the other problems you’re worried about either will get solved on their own or won’t be as a big deal as you think.

- Build your prototype in weeks, not months. You’re going to get lots of ideas. Don’t spend months trying to build a prototype. Build something simple to test out the core assumptions of your idea. In a few years, your prototypes will be built in days.

- Your first few prototypes are going to fail. You’re going to work really hard on your first few prototypes only to find out that they don’t work. That’s okay because you’ll learn so much that it will make you more likely to succeed with your next prototype. But, what’s not okay, is spending months and months building those prototypes.

- Lastly, I have an idea for you. When the iphone comes out, build a photo sharing app where you help your users make their photos look better by adding filters. Call it “Instagram”. Trust me.

While I have yet to figure out how to go back in time, I hope others who are just starting out can benefit from the advice above.

Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

When Jim and I quit our finance jobs to start the next big thing, we were really unprepared for our startup journey.

We didn’t have startup experience, we had no real domain expertise (our startup wasn’t going to be about finance) and we didn’t know any investors in the tech community.

There was very little reason for them to want to invest in our startup.

Exactly three years later, we raised $1.3 million for Yipit, a daily deals aggregator, from Ron Conway and David Lee’s SV Angel, RRE, DFJ Gotham, IA Ventures and a handful of other amazing tech investors.

This post isn’t about the tactics we used once we started getting interest, I’ll share that with you later and you should check out VentureHacks. The point of this post is more to share how we put ourselves in a position to get interest from high-profile tech investors. Hopefully, it well help you as you try to do the same.

Note: We didn’t think of raising money as a goal. I highly encourage you to consider starting a boot-strapped cash-flow positive business. For us, the ideas we working on needed scale before we could monetize them which required us to raise funding.

How We Did It

Below are the the key moments in our journey:

- Realized we needed traction. This was key. Unless you’ve successfully started another company or have serious domain expertise (we didn’t), you need traction. Traction is essentially positive momentum in customer growth. For us, it would mean sharp user growth. Trying to raise money before traction is largely futile. So, we stopped putting together business plans and powerpoint presentations and set out to build a prototype that would get us traction.

- Built relationships with potential investors. While we built our prototype, we started meeting with potential investors. To be *very* clear, we were not asking them for money and didn’t bring presentations. We just wanted them to know who we were and what we were working on. The first two investors who committed to our round came from these early meetings. I also remember another investor positively commenting that “we were known entities”. In other words, they were more comfortable investing in people they had known for a while.

- Released our prototype. The initial version of Yipit was an aggregator of all sample sales, happy hours, deals happening in New York. We put out a private beta in June of 2009 and publicly released it in December of 2009. By end of January, we had a few thousand people signed-up. Not bad, but we didn’t have real momentum.

- Decided to raise a small seed round. At this point, we had been living off of our savings and had decided to finally raise a small seed round to cover our expenses and start paying ourselves a small salary to end our savings leaking. We met with a few investors and they weren’t interested. We didn’t have traction. So, we immediately canceled meetings with other investors. We instead turned to people who were willing to invest in us because they believed in us: our friends and family. We quickly closed the round in late January.

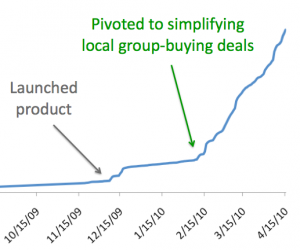

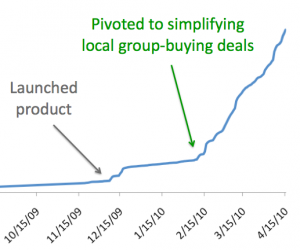

- Pivoted to focus on aggregating just daily deals. During our meetings with investors, we heard two business critiques: we couldn’t easily scale to other cities (this was true) and it would be hard to monetize beyond basic email advertising (also true). Fortunately for us, while we spent all this time organizing deals, a very successful company launched called Groupon that created deals in cities. By late January, there were 12 companies now doing exactly what Groupon did. We then pivoted Yipit in February to just focus on aggregating these new daily deals. The new version addressed the two main concerns we had heard from our investors: we launched in five cities and we could monetize via affiliate relationships.

Successful Pivot (Y-Axis is Subscribers)

- Pivot got us traction. As you can see from the chart, our user growth shot up and we now had real momentum and traction.

- Investors started calling. By April, we started getting calls from investors wanting to know more about Yipit. At this point, we were getting buzz in the press, signing up users and the industry was on fire as Groupon and LivingSocial were raising huge rounds and there were now 40 plus daily deal services.

- Decided to raise large seed round. We decided to raise around $1 million round to build out the team and give us 18 months to hit certain milestones. Because we had built up relationships with investors, we didn’t have to cold email anyone. We just reached out to them and met with the investors that were calling us.

- Demonstrated we weren’t naive. As a first time-entrepreneur, investors are worried you are naive about the challenges facing your startup over the next 12 months. Every startup has risks and your startup and our startup are no exceptions. When an investor would bring up a risk, we wouldn’t vigorously defend ourselves saying it wasn’t a risk. Instead we would tell them that it was a real risk for us and we were very focused on mitigating that risk over the next 9 months by doing X, Y and Z.

- Got first lead investor. RRE was the first to commit to investing in us and it all got really easy from there. The social proof of having an investor with a great reputation backing you does wonders for your fundraising process.

- Closed up the round. We had calls, meetings with potential investors almost every day in May and closed the round at the end of June. Aside from investors reaching out to us, the best source of investor leads is to ask the investors who are committing to recommend other investors that might be interested. We also used VentureHack’s AngelList at the very end. (Will be sharing more about our experience closing the round in future posts).

Getting Traction was HUGE

As you can see, getting traction was huge for us. But, we were also well-positioned to take advantage of it because we had built relationships with investors and had been keeping their feedback in mind.

If you’re trying to raise money as a first-time entrepreneur, I really recommend you get a prototype out there and find your traction before you spend time creating decks and pitching investors. And, if you need to raise money in order to build a prototype, you are underestimating what you are capable of.

Vinicius Vacanti is co-founder and CEO of Yipit. Next posts on how to acquire users for free and how to raise a Series A. Don’t miss them by subscribing via email or via twitter.

Lastly, what are we doing with the new round of funding? We’re expanding the team.